UK Outfit Sees Broker Lawsuit as Opportunity To Expand Into American Market

GUEST POST: Boatshed's Chapman Says Buyer Reps, YachtWorld Like a 'Conspiracy'

Preface: This article was originally written and published by Peter Swanson on “Loose Cannon” and is reproduced here in parallel by prior arrangement, as part of our team effort to cover this ongoing story to its full extent. — Phil Friedman

Neil Chapman is keeping an eye on the litigation now threatening to disrupt the way America buys and sells boats. What’s more, this British sailor and brokerage boss says his company’s approach—the company is Boatshed—is poised to expand into the U.S. amidst any resulting wreckage and rubble.

Chapman was “beating up the coast of Portugal” recently, mulling the litigation entitled Ya Mon Charters vs. International Yacht Brokers Association et al, when he reached certain conclusions, including “that there is a conspiracy.”

Chapman sees the issue as one of toxic symbiosis between buyers’ brokers and the venture-capital ownership of the YachtWorld multiple listing service. Together, they are preying on their customers, he said, writing after he had arrived at his next port.

As I see it, basically the buyer brokers convince wannabe boat owners (or seasoned ones in their network) that buying a boat is really complicated, and the buyer absolutely needs them to overcome the huge number of challenges. This starts with the fact that only they have access to the MLS systems required to be able to find boats for sale, and only they have enough contacts within the broker industry to be able to find certain "hidden" boats for sale.

Next, the buying process is extremely complex and full of potential pitfalls that an unguided buyer could fall into. Then, only an experienced buyers broker can handle the complex negotiations and process of survey and sea trials, etc.

These buyers’ brokers are essentially preying on boat buyers convincing them that their role is essential to avoid possible nightmare scenarios. We have met and dealt with plenty of these "experts" over the years, and some of the stories would make your hair curl.

Many of them know little about boats but put on the show to "protect" their client from the complexities of the marine industry. These buyers brokers then scour the market for sellers’ brokers to bring their considerable experience to bear on.

They only want to deal with sellers’ brokers who have sole-agency contracts and high rates of commission. After all, their commission for bringing a buyer is clearly more lucrative and safer if they avoid risky non-exclusive or low-commission transactions.

These buyers are essentially hoodwinked into using these buyers brokers, and the buyers brokers—in conjunction with the larger sellers brokers and the larger marketplaces—perpetuate the myth that if you must use broker with sole agency and high commission or you run the risk of not selling your boat.

If you take an average brand model of a boat, plus engines, rig, manufacturer of electronics, etc., each boat is unique plus there are such small numbers of each brand new model for sale, so using Google or other search engines, these boats are not difficult to find.

I think I'm coming back to more of the thinking that there is a conspiracy, but I think it's controlled from the buyer-broker perspective, which is creating a situation where sellers’ brokers have no alternative than to follow what that sellers are telling them, which is, if it isn't on YachtWorld, no one will find it, and if we don't have a really good commission rate, then the buyers’ brokers won't be interested in working with you and ultimately the whole system goes round and round again.

According to Chapman, Boatshed divides the boat selling process into five modules, each addressing different aspects of a sale:

Finding the listing: Identifying and securing listings.

Local role: Recording detailed photos and inventory, and conducting showings.

Broker negotiator role: Managing negotiations, customer interactions, and progressing the sale.

Admin, closing and client funds management: Handling administrative tasks, closing processes, and managing financial transactions.

Platform, marketing and technology tools: Provides the essential technological support that powers marketing efforts and enhances listing visibility, leveraging Boatshed’s robust platform to streamline the sales process.

Chapman said that a yacht sale typically involves different people (or groups of people) for each of the above roles. Boatshed brokers negotiate the commission like their American counterparts but the average is less than the typical American 10 percent.

Chapman said the group’s “generally achieved commission” is about 7.3 percent, which is distributed equally five ways to the participant or participants in each module. Boatshed has been using this business model for 25 years.

The module that might seem most foreign to American brokers is No. 2, the part about the photography. For a boat to be listed on the Boatshed website, it must be photographed in a way that reveals the true condition of the vessel “warts and all.”

The usual interiors and running shots are supplemented with standard photos of, say, the chain locker, engine-room wiring and the bilge—not just anywhere in the bilge—but at the location of the bilge pump. For example, a listed Morgan-Catalina had 68 photos in the sales package.

None of which precludes the traditional role of a surveyor representing the buyer pre-purchase. (See YouTube video below.)

Chapman said that American brokers might see this kind of disclosure as counterproductive, but in fact the sellers appreciate that kind of approach. Chapman said:

Originally, the business did lots of physical viewings leading up to the sale of a boat. But after introducing transparency with, for example, images of the bilges and wiring, and showing the boats “warts and all,” we found that we’re actually selling boats twice as fast as other brokers.

And, previously where we were doing an average of 16 physical viewings per boat sale, in the majority of cases that’s now down to just two. Notably, feedback and comments from sellers was how surprised they were that it was the first person who viewed the boat who purchased it.

One area of contention in the Ya Mon lawsuit is the practice of paying a buyer’s broker from the seller’s commission, which plaintiffs see as unfair to sellers. That’s not how it usually works in a Boatshed deal.

“Boatshed brokers are not permitted to act as buyers’ brokers but that doesn't prevent them from being approached by independent brokers acting on behalf of a buyer and demanding a portion of the commission. It's just rare,” Chapman said.

Hey, you American brokers. Share your opinions in the comment section below.

Boatshed has franchises in 80 locations and 16 countries—120 brokers in all. Each office is a separate, legal entity with its own business and name, while using a single online platform that handles all contracts, financial transactions, training and support. Chapman said Boatshed has a track record of selling 70 percent of all the boats it lists. It has a public archive of 25,000 boats it has sold in the past.

Website Kicks Ass

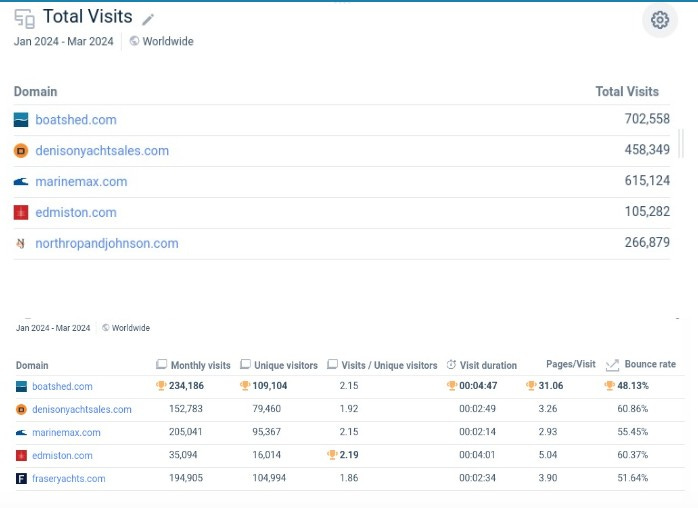

Another sign of Boatshed’s powerful presence in the marketplace are its website statistics, which compare favorably to those of America’s top brokerages, as this chart shows:

Like MarineMax, Boatshed has its own deal with YachtWorld, but like his American colleagues, Chapman is not enamored with the brand. He foresees an end to YachtWorld’s “vice-grip level control” over the yacht market.

Boat Group, which is YachtWorld’s parent company, was most recently purchased by venture capitalists for about $400 million, and Chapman said their goal is to sell it for $800 million. He said these faceless capitalists have no appreciation for the fact that the boating industry and its customers comprise a single ecosystem of enthusiasts, and they see it instead as bottomless lode of extractable wealth.

As a result, Chapman said, YachtWorld has entered a spiral. To make their sales goal, they must raise rates on listings. As they raise rates on listings, more brokerages are opting out, so YachtWorld must raise rates again to make its numbers.

Meanwhile, dissatisfaction with YachtWorld has spurred “an ongoing succession of wannabees” nipping at its heels but never quite taking it down. One example, the International Yacht Brokers Association (the first listed Ya Mon defendant), has launched an online listings platform called Yachtr, in collaboration with eBay.

Chapman’s American ambition is to make Boatshed the “Amazon for Boats,” open to anyone who wants a “collaborative tool for third-party brokers who may wish to leverage this structured approach to enhance their own operations.”

Chapman’s pitch:

This model not only streamlines the selling process but also fosters teamwork among brokers, allowing them to focus on specific tasks they excel at, rather than managing the entire process alone. By standardizing